Motivation

The problem

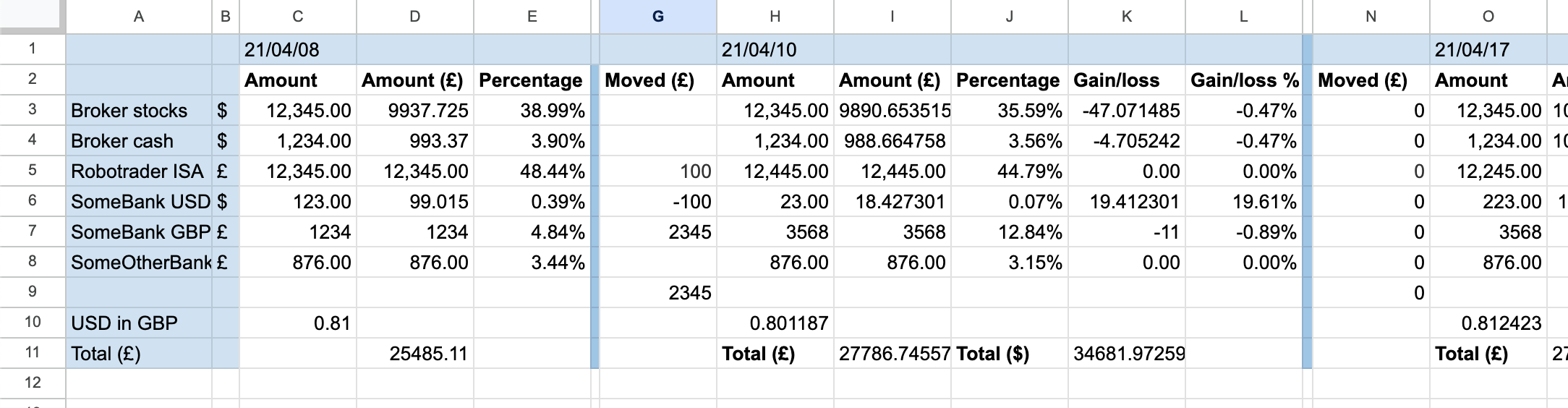

The first problem we will solve with Beancount is tracking the total value of various accounts (like a snapshot) to see the current state of affairs and also the dynamics over time.

This is already not straightforward to do when you have more than one bank account, and maybe one or two accounts open in various other financial institutions (brokers, funds, etc).

The natural thing to do would be to use a spreadsheet, and this is what I used for a while. However, to display the graphs and various other information that spreadsheet would have to become rather complicated . Also any new changes to, say, the set of accounts may require you to make changes in the spreadsheet which is error-prone and not always convenient.

Instead we are going to track total values in the Beancount files generated using special UI.

The process

In order to keep the whole thing up to date you will need to choose the frequency for manually updating data for all your accounts. Specifically, you will need to log in into all your institutions and put down the current value into the file as described below. Consider putting a weekly task in your calendar to form a regular habit.

How often you want to “sample” these data points, is up to you. I would recommend doing it:

- On the 1st day of every month.

- Additionally, on 15th of every month to double the number of data points.

I have corresponding reminders in the calendar. The reason to do it on the 1st of each month is so that you can use Fava’s month, quarter etc filters and the pad transactions (you will read about these on the page with more detailed explanation) for the month will fall into the corresponding month precisely.

Overall it would take 10-15 minutes of your time each session. You may choose to contemplate any financial decisions at the same time, or do any other financial chores. Regularity is the key and doing this at roughly even intervals will ensure the availabilty of the data later on and clean looks of your graphs.

Once you follow the guide and automate some of the things you may simplify this process further. Some accounts may be updated retroactively. Even when your bank transactions are fully automated (maybe even with imported balance statements), I would still recommend to keep updating totals manually as errors may happen and manual tracking will provide a way for you to find and debug them. Following this process rigorously will ensure that your net worth over time will always be tracked precisely – and this, in my opinion, substitutes a fundamental requirement to the system. You may make errors or miss some transactions elsewhere, even with automated tools something may go wrong. Errors in total values for the accounts are easier to spot which will nudge you to correct other errors before they affect your graphs, reports or even decisions.